Industry Overview

In recent years, the oil and gas industry has entered a new era of operational oversight and asset management. Companies are moving beyond traditional inspection techniques and embracing aerial systems as part of their digitisation journey. In this evolving environment, drone-based solutions are increasingly seen not just as a novelty, but as a strategic tool to enhance safety, reduce downtime and enable remote access to challenging terrain.

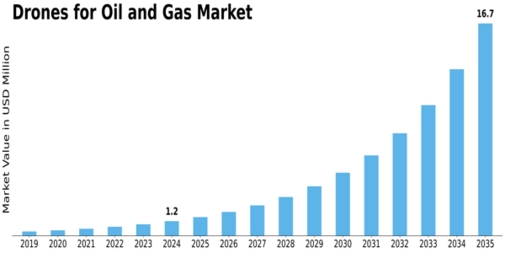

Market Outlook

The global market for drones in oil and gas was valued at roughly USD 1.16 billion in 2024 and is forecast to soar to approximately USD 16.75 billion by 2035, implying a compound annual growth rate (CAGR) of around 27.5% over the period. This impressive trajectory reflects the convergence of several macro-drivers: regulatory facilitation, technological advances (including AI and thermal imaging), and heightened demand for safer, more efficient inspection and monitoring operations.

Key Player Roles

Leading firms in this space are helping shape the ecosystem. For example, Delair offers integrated hardware and analytics platforms tailored to industrial deployments. Airobotics builds automated airborne data-collection systems. Terra Drone has entered joint R&D partnerships focused on offshore storage-tank inspections. Together, these players craft the hardware-software interplay that drives real value in oil & gas operations.

Segmentation Growth

From a type-perspective the market is broken down into segments such as fixed-wing, single-rotor, multi-rotor and hybrid/nano drones. The multi-rotor category currently holds a leading share because of its affordability and flexibility. On the application side, key usages include inspection, security & emergency response, and surveying & mapping—with surveying & mapping emerging as a dominant segment due to exploration and reservoir analytics demands. Regionally, North America leads, driven by strong offshore production activity and investments in exploration.

Closing Thoughts

For oil & gas companies, adopting drones is increasingly less about experimenting and more about operational necessity. As the market grows, vendors will need to offer not just flight hardware but deep analytics, integration with existing workflows and robust safety/ regulatory compliance. In short — the sky is no longer the limit, it’s the launchpad.