Winning teams treat insights as an operating system, not a report. Strong market research ties voice-of-customer, stylist feedback, and performance analytics into product roadmaps and go-to-market playbooks. Qualitative inputs—fit issues, bond comfort, color ambitions—become testable hypotheses, while quantitative signals—attach rates for care kits, reorder intervals, return drivers—prioritize what to fix or fund next.

Start with a clear segmentation. Distinguish event-based users from everyday wearers; human hair loyalists from synthetic-savvy shoppers; salon-first clients from DTC explorers. Each segment values different claims: believability, heat tolerance, weight, reinstall speed, or ethical sourcing. Map those priorities into copy, packaging, and consultation scripts.

Product decisions should be evidence-led. If slippage concentrates at weeks 3–4 in humid regions, revisit adhesive formulas or educate on clarifying routines before installs. If color mismatch drives returns, expand neutral and cool undertone options and invest in better swatch photography. For synthetics, publish safe temperature ranges and tool recommendations; for human hair, detail processing steps and post-color expectations.

Merchandising benefits from clarity. Bundle essentials—brush, silk accessories, heat protectant—with first installs to de-risk outcomes. Offer care subscriptions aligned to average wear cycles. Create “method kits” (tape-in, bond, clip-in) with tailored instructions and QR-linked videos. Transparent pricing with line items for hair, labor, color blend, and maintenance builds trust and reduces cart abandonment.

Research should also assess channel economics. Salons drive high satisfaction and word-of-mouth but require training, certification, and reliable supply; DTC broadens reach and enables data capture but demands robust education to avoid misuse. Hybrid models can capture the best of both: online discovery, in-salon expertise, digital replenishment.

Measure what matters. Track lifetime value by method and fiber; monitor NPS post-install and after first wash; follow defect and return codes to the root cause. Close the loop by sharing findings with suppliers and stylists, and by updating instructions and product specs accordingly.

Finally, ethics and sustainability are proving sticky. Transparent origin stories, fair-labor commitments, and packaging reductions influence premium buyers and corporate partners alike. Building verification into brand storytelling turns a potential risk into a durable advantage.

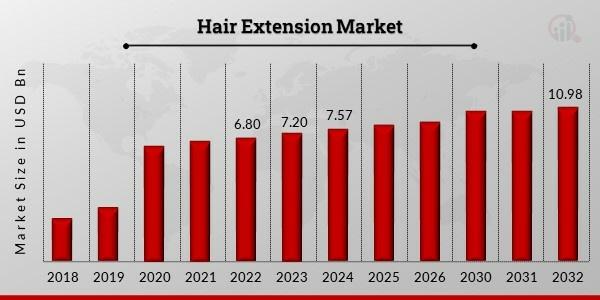

For comprehensive sizing, segmentation, and competitor views, consult the latest Hair Extension Market intelligence, and for project planning, survey templates, and data frameworks, tap into focused hair extension market research.